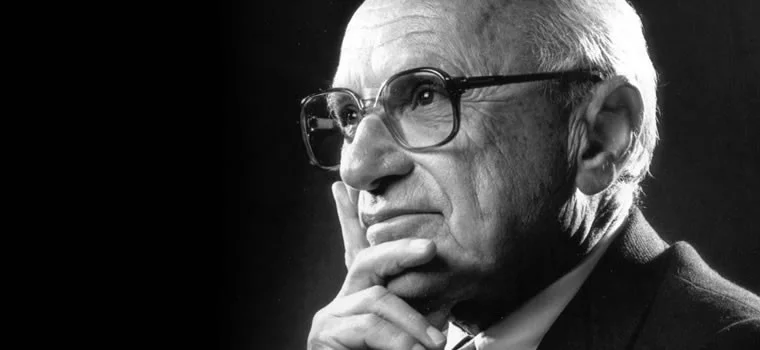

Poor Milton Friedman. The Nobel Prize-winning economist and Chicago-school anti-Keynesian had a lot of good ideas, and was unmatched at explaining complex economic theories in a way that non-economists could understand. But he keeps getting yanked out of his grave and waved at anybody who even hints that business might have some responsibility to society.

You've probably seen the quote: "There is one and only one social responsibility of business—to ...increase its profits...." It's from an article in the New York Times Magazine from September 1970, and it doubles down on the position he took in his 1962 book Capitalism and Freedom.

In the article, Friedman argues quite hyperbolically that managers of businesses should only engage in activities that benefit shareholders, and that social responsibility is a dangerous distraction. He refers to CSR as “pure and unadulterated socialism” and its proponents as “unwitting puppets of the intellectual forces that have been undermining the basis of a free society these past decades.” It's pretty much the 1970’s version of clickbait.

Milton Friedman was recently exhumed in a Harvard Business Review interview with Merck CEO Kenneth Frazier, who famously resigned from President Trump's American Manufacturing Council after Heather Heyer was murdered at a white-power march in Charlottesville, Virginia in August 2017. In the article, Frazier explains, "When I saw what had happened in Charlottesville and when I heard ... [Trump's comments sympathetic to the white supremacists], I felt a strong conviction that by not taking action I would be endorsing what had happened and what had been said."

The HBR interviewer then gets out his gravedigging shovel, and suggests that Friedman might argue that being "anti-white-supremacist" could be bad for Merck's shareholders. Frazier's response includes the phrase, "I think businesses also exist to deliver value to society." This then prompts pro-Friedman business bloggers to say things like, “My immediate reaction was to wonder how Merck's shareholders would respond to such a quote from their CEO.” Seriously?

So let's put this trope, and Professor Friedman, to rest once and for all.

In 1970, cutting edge business strategy research was all about optimization and maximizing shareholder value through increasing market share.

In 1980, Michael Porter published Competitive Strategy, and shifted the focus from shareholders to customers.

Today, it's widely acknowledged that designing products and services to maximize value to customers and then capturing some of that value is the way to go. And as we've discovered, social responsibility is now a product feature and not an externality. In other words, some consumers derive value from socially responsible practices, giving companies that are creating that value something new to capture.

And while I can't speak for him, I'm pretty sure that Milton Friedman would have been totally cool with that.

Are you ready to start creating and capturing value with your corporate social responsibility programs? Please contact us for a free consultation.